Bitcoin.

A crypto-currency.

A decentralized application.

A bubble.

An investment.

A speculation.

The next big thing after the Internet.

These are only some of the epithets and descriptions people like to give to bitcoin. The reality, however, is that none of them really describes what bitcoin is and how this idea will, probably, redefine the future of humanity forever.

For me, the journey to the mystical landscape of bitcoin started almost 5 years ago. Back then, I wasn’t really involved in investing and businesses. I was just starting my baby steps in the entrepreneurship world and I was just following mainstream startup outlets to educate myself on the happenings of the community. The term bitcoin was still very nebulous, but most of the technology geeks in the startup world showed interest in it and that was enough to tantalize me a bit.

In the beginning, my interest was infinitesimal, since its valuation was insignificant and the technology seemed quite complicated and unsexy to invest the time required to understand its mechanics. As time went by, I kept following the trends and, although I was still a bit reluctant, I started to realize that this seemingly trivial speculation became a serious life investment for some people.

The year I decided to take bitcoin seriously was the year 2015 and it coincided with my reading of the book “Sapiens” by Israeli historian Yuval Noah Harari.

In this magnificent work, Harari explains how, throughout the history of mankind, humans created powerful stories in order to give our lives purpose and consequently ensure the stability of our social edifice. Without stories, we feel lost and desperate. Stories metamorphose our lives into adventures and act as moral compasses that allow us to recalibrate our existence during dark times.

I saw the power of stories everywhere around me. In religions, in politics, in social theory, in economics, in movies. And that’s when it dawned on me. I came to realize that bitcoin is nothing more than another story. A story created by some extremely intelligent people and gained steam by being adopted by more intelligent people. When smart people come together and unite around a powerful story, you can’t help but realize that there is serious potential in it.

So, I decided to invest a significant amount of money in this story and, today, view it as one of the most important investment decisions I have ever made.

As a serious bitcoin hodler (I explain below) and a person who has skin in the bitcoin game, I consider it a personal responsibility to educate people around the bitcoin story and also evangelize its use so that its promises can eventually be materialized.

Explaining hodling: Back in 2013, member GameKyuubi of the bitcoin forum bitcointalk.org, started a post titled “I AM HODLING.” This was a 200-word rant of him expressing how difficult it is to be a bitcoin trader with the constant ups and downs. Obviously, he didn’t realize that he misspelled the word hold, but the bitcoin community adopted the word and made it a word of reference for everyone who believes in bitcoin and is willing to hold no matter what.

In the following paragraphs, you will read not only my explanation of the bitcoin story so far but also an analysis of the underlying meaning of this story.

Enjoy.

UNDERSTANDING BITCOIN: HOW IT ALL STARTED — THE SATOSHI NAKAMOTO STORYLINE

October 31, 2008. In a cryptography mailing list called metzdowd, devoted to cryptographic technology and its political impact, a member with the name Satoshi Nakamoto published an email titled Bitcoin P2P e-cash paper. In this email, Nakamoto introduced the members of the list to Bitcoin: A Peer-to-Peer Electronic Cash System.

It was an exceptional piece of work predicated on a very revolutionary idea — how to send online payments directly from one party to another without the burdens of going through a financial institution.

In a nutshell, what Bitcoin does is it creates a robust decentralized network of exchange that is based on a technology called blockchain. Now let’s explain the fuzzy terms:

Decentralized: This means that there is no central authority that regulates the transactions. In our current state of affairs, if I want to send money to someone online I need to do so through an intermediary like a bank or an online payment processing system (paypal, stripe etc.). This kind of system creates a plethora of problems ranging from hidden fees to lack of anonymity and also a huge dependency on the system itself.

Blockchain: This is a technology proposed by Nakamoto that tries to solve the infamous double spending problem. Double spending occurs when the same single digital token can be spent more than once. This is possible because a digital token consists of a digital file that can be duplicated or falsified. Imagine the equivalent of counterfeit in digital form. He addresses the issue by creating blocks of transactions within the network called a blockchain that are cryptographically secured. The level of cryptography entailed in this process is quite sophisticated and ensures that the transactions are safe and that there is no ambiguity behind the operation of the network.

One can realize the depth of Nakamoto’s intellect by reading how elaborate the structure of his/her/their work is. This paper is not something a normal person could come up with. It is a very complex algorithmic process that requires a great deal of knowledge in computer science, mathematics, and cryptography.

My estimation is that Nakamoto, although in the paper he makes use of “we,” is one person and most probably a male with a high-level degree, possibly a PhD, in computer science or cryptography. People suggest that he is of British descent because in various posts he makes use of Britishisms, such as “bloody hard,” and that he dwells somewhere in the eastern parts of the Americas (because of the timestamps on his e-mails). His command of the English language is quite advanced and that suggests that he is a native English speaker. The name Satoshi Nakamoto is clearly a pseudonym and it could have been picked for various reasons. Satoshi is a very common Japanese name (one of its interpretations is philosophy or enlightenment) and Nakamoto means ‘central origin’ or ‘(one who lives) in the middle.’ One could make the assumption that the use of the words Satoshi and Nakamoto allude to the idea behind Bitcoin and its decentralization theme. Also one could presume that he spoke Japanese or that he admired the Japanese culture.

Regardless of how the persona of the bitcoin creator is interpreted, one thing remains certain: This person was extremely intelligent, he valued his anonymity and he wanted to ensure that he wouldn’t stay long in the spotlight.

After his initial email in the cryptographic community newsletter, he released the Version 0.1 of bitcoin software on Sourceforge on 9 January 2009. According to Wikipedia, “Nakamoto created a website with the domain name bitcoin.org and continued to collaborate with other developers on the bitcoin software until mid-2010. Around this time, he handed over control of the source code repository and network alert key to Gavin Andresen (lead developer in the Bitcoin project), transferred several related domains to various prominent members of the bitcoin community, and stopped his involvement in the project.”

His final email or personal message to the bitcoin community is dated April 2011. In it, he told to Mike Hern, one of the developers of the bitcoin code at the time, “I’ve moved on to other things. It’s in good hands with Gavin and everyone.”

Satoshi Nakamoto is now a legendary figure. The public bitcoin transaction log shows that Nakamoto’s known addresses contain roughly one million bitcoins (they were all part of the first blocks mined). As of 17 December 2017, this is worth over 19 billion USD. This makes him the 44th richest person on earth.

THE POST-NAKAMOTO ERA

Since Nakamoto rejected the role of the new messiah (very smart move in my opinion), the bitcoin game became open to anyone willing to influence it. The first popular bitcoin transaction was documented in May 2010, when Laszlo Hanyecz, a programmer from Florida sent 10,000 Bitcoins to a volunteer in England who spent about 25$ to order him a pizza from Papa John’s.

Afterwards, the cryptocurrency started being covered by different media outlets, thus gaining steam. A huge number of tech-savvy investors saw enormous potential not only in bitcoin itself but also in its underlying technology, the blockchain, which can be used in a wide array of applications ranging from banking to file sharing and even government-related processes.

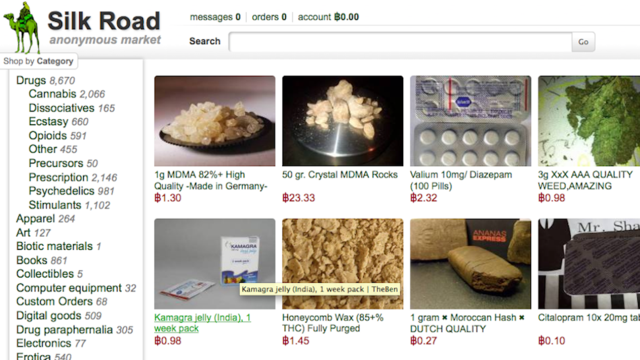

Apart from the first Bitcoin exchanges that allow people to buy and exchange bitcoin, many people start to accept this new currency as a form of payment and, not surprisingly, the most passionate early adopters are drug dealers. Silk road, an illicit drugs marketplace which used Bitcoin as an untraceable way to buy and sell drugs online, is established in January 2011, paving the way to the evolution of the dark web and the creation of a whole new online ecosystem.

Slowly but steadily Bitcoin becomes more reputable and, as a result, new cryptocurrencies that want to compete with it emerge. People believe that there is always a better version of a new system and want to be the first who will invent this “better version.” Etheruem, Litecoin, Monero, Ripple, Dash are some of the earliest alternative cryptocoins to appear in the scene and are still amongst the most dominant players in the landscape.

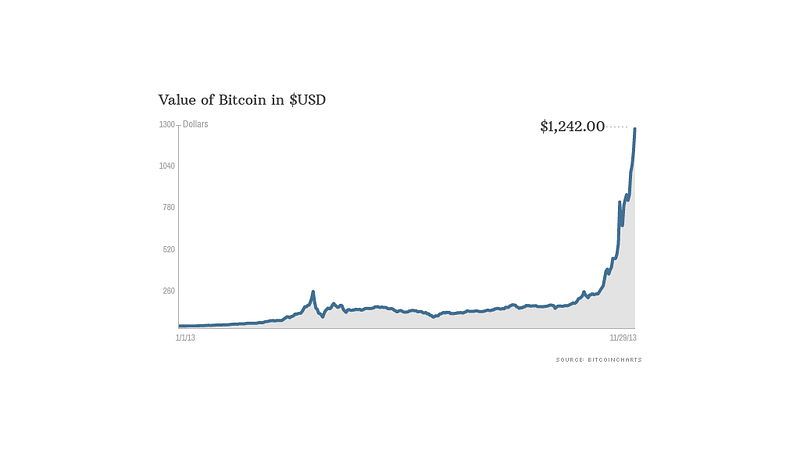

2013 marks the most important year for bitcoin since it was the year when the bitcoin price experiences its highest surge. On November 29, 2013, the price of a single coin hit an all-time high of $1,242.

Something important to note here is that, usually, surges and declines in prices occur due to statements by influential figures or critical events in the development of the currency.

For instance, in November 2013, Bitcoin received the blessing of Ben Bernanke, the chairman of the Federal Reserve. That is not a small thing. Ben Bernake is one of the most prolific individuals in the finance world. His opinion is taken very seriously and many people will experience the need to invest in Bitcoin when it is promoted by someone so reputable.

But there is also the other side of the coin. In 2014, Mt. Gox, the most famous Bitcoin exchange at the time closed its website and exchange service and filed for bankruptcy protection from creditors. That, along with the shut down of Silk road in November of the same year, marked the plummeting of the Bitcoin price to around $300.

From 2015 until the end of 2016, Bitcoin slowly scaled up the charts to reach a value close to $960 by December 2016. The number of miners, developers, and investors associated with Bitcoin during that period grew exponentially.

And that brings us to 2017, the most prosperous year for Bitcoin, to date. I am not entirely sure what happened in 2017, but I guess that when you create a story so alluring and with so much future potential that will allow early investors to make money out of, literally, thin air, at some point this story will explode.

Bitcoin entered the mainstream, buying the currency became very easy, many prominent and respectable figures started endorsing it and, as a result, one of the most interesting creations in the history of mankind skyrocketed in value.

THE REAL VALUE OF BITCOIN

Regardless of whether you have skin in the Bitcoin game or not, you need to understand something very fundamental about this idea:

Bitcoin isn’t something that emerged out of the sick or crazy mind of a random programmer. Bitcoin was something that was desperately needed by all of us.

The banks and the governments have been controlling the monetary system since the beginning of time (not really that long but it feels like it) and this creates all sorts of problems for the average person.

First and foremost, we are dependent on two entities that can decide about how money is circulated within the society without them being omniscient. Namely, their decisions are not based on a flawless system that will ensure the stability of the social edifice, but rather on economic assumptions that are usually influenced by the needs of certain individuals. Individuals that are high up in the dominance hierarchy of society and will do whatever it takes to maintain their power and wealth.

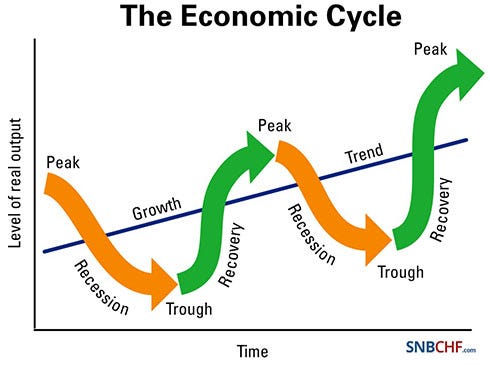

The evidence of how blemished the current system is, is indisputable. Our economic life isn’t a straight line that leads to sustainable growth but rather a playful interplay between moments of crisis and moments of prosperity.

This occurs due to faulty interpretations of the current system and the fact that we are delusional with regards to its limits. Whenever we hit a roadblock, we try to squeeze everything we can out of the monolithic structure we have created, thus creating debt and bubbles. These bubbles, in respect, lead to moments of crisis where we seek the intervention of “the invisible hand” which offers temporary and unsustainable solutions to our predicaments.

The funny part is that the inexorable propagation of this system can’t continue forever and it will evidently lead to anomalies. From my understanding, such an anomaly we experience at the moment with the dawn of Bitcoin and other cryptocurrencies.

Bitcoin suggests something very simple, yet something very revolutionary:

It’s the first time in history we can start discussing alternatives to the current Fiat standard. Back in the 1800s people used to rely on gold to estimate the value of the currencies in circulation. Every dollar was connected to a certain amount of gold and that helped the value of a dollar stay stable. This system was quite efficient, but not really that flawless.

Fiat explained: Fiat is a Latin word that means “let it be done” and it is used to signify an order or decree. That is, fiat money is money issued by the government and regulated by the government. It has an assigned value only because the government uses its power to enforce the value of a fiat currency. Every country in the world has a fiat currency that is issued by the respective government and is susceptible to economic fluctuations, such as inflation or deflation.

During the great depression in the 20s, the gold standard inhibited economic growth because it prevented the Federal Reserve from expanding the money supply to stimulate the economy, fund insolvent banks and fund government deficits that could “prime the pump” for an expansion.

Also gold, in and of itself, doesn’t have any tremendously significant usability. Yes, it can be used in jewelry, electronics, and some other industries, but that alone isn’t enough to make it an important asset. What triggered the idea of a gold standard was that gold was a very expensive metal with limited circulating supply.

Which is an argument tantamount to the Bitcoin argument. When Satoshi Nakamoto invented Bitcoin, he did so with the intention of creating a specific amount of Bitcoins that could be mined. Specifically, there are 21 million Bitcoins to be mined and, according to estimations, the last bitcoin will be mined in 2140.

Bitcoin Mining: The mining of bitcoin isn’t a simple process. When Satoshi introduced us to the concept of Bitcoin, he also created a mathematical algorithm that allowed programmers to mine it using powerful computers. The need for a powerful computer is essential because the way this algorithm works is that it makes computers compete with each other in order to decode specific cryptographic elements involved in the process of bitcoin creation. This video explains it in detail. Basically, each block that is added in a blockchain contains a specific amount of bitcoins that can be mined by solving a cryptographic riddle. Every four years the block size is halved and the number of bitcoins that can be mined in each block decreases. Satoshi did that to make the game of mining more interesting and probably lengthier.

If we take the limited circulation into account and add on top of that the incredible feasibility and usability prospects of bitcoin, that include decentralization, security, anonymity, and ease of use, bitcoin becomes one of the most important alternatives to fiat currencies the world has ever seen.

WHAT THE AVERAGE PERSON DOESN’T GET ABOUT BITCOIN — PHILOSOPHICAL ARGUMENT

On the surface, Bitcoin is a digital currency. For when people get interested in it they do so because they see it as a form of investment or as an alternative payment method. However, when one starts to dive deeper into the idea of what Bitcoin represents, one can see something quite groundbreaking. One can see the future of humanity.

If you take a look at our history as species, you will realize that our progress is predicated upon the progress of our governing systems. What we are constantly trying to achieve is the optimization of our societies in order to reach a state of universal equality and dissipation of suffering. We have tried monarchy, oligarchy, democracy, communism, and other forms of governance and none of them have lived up to our expectations. Our ideal political system is none of that.

Ideally, we would be happy with a mode of anarchy that favors the ability of the individual to offer value within society. We don’t need governments to take care of us. We know that we can do that by ourselves, but the mere structure of our social patterns don’t allow us to do so.

Especially when the monetary system is structured in such a crazy way.

And here is where the idea of Bitcoin comes into play. Bitcoin is a decentralized system, which means that it is not governed by anyone. This seemingly small idea can lead to a monumental shift in the way we interact with each other and eventually re-engineer our whole thinking motifs.

The average person doesn’t see that. However, bitcoin renegades do see it. And if they don’t see it, they feel it. That’s what makes them so crazy about bitcoin. That’s what really keeps them investing in it.

Throughout my whole life, I have been part of many social groups. I have been part of football teams support groups, I have been part of university groups, I have been part of political groups. During my interaction with various entities within the groups I joined, I noticed a similar pattern. The groups that usually prevailed were the ones whose supporters showcased two important attributes: Dedication and intelligence.

Dedication is required in order to keep the group running. Without dedication, the members can’t stay engaged and, eventually, the group dissolves. However, dedication alone isn’t enough. You can be dedicated, but if you aren’t smart enough to understand what goes on behind the veil of reality, you can’t sustain a group’s stature and also outperform other groups.

The bitcoin community is comprised of some of the most dedicated and intelligent people I have ever encountered in my whole life. Take a look at this talk by Bitcoin evangelist Andreas Antonopoulos:

The intellectual rigor and the passion entailed in his speech is contagious. And he is just one of the many intellectuals that have embarked on the bitcoin train and are urging the rest of us to join too.

Notwithstanding, an important thing to note is that the major adopters of the bitcoin philosophy aren’t the average joes of the world. They are people with skin in the game of technology and knowledge in areas like programming and engineering. That adds a layer of security in the bitcoin movement that very few revolutionary movements in the history of the homo sapiens species accrued.

IN CLOSING — IS IT A BUBBLE AND WHAT WILL DETERMINE ITS FUTURE?

Most people will fight bitcoin and that’s a fact. That fighting is not just a byproduct of an astute lack of understanding in the concepts I just described, but also triggered by a resistance to change and the inherent self-preservation mechanism most humans fall a victim to.

What will determine bitcoin’s robustness is the community’s major players’ tenacity to keep on playing and that involves miners, programmers, investors, evangelists and entrepreneurs who are willing to risk everything to make this work.

History is full of similar revolutionary movements and we all know that the change such a revolution will bring about isn’t monumental, but it is definitely a change in a better trajectory than the one we are heading.

The use of the word bubble many bitcoin anti-sympathizers are prone to is fallacious since most bubbles in history were carried out by scammers who were willing to take advantage of people’s greed. Bitcoin is far from what these people promulgate.

Yes, some ICOs have a bubble element entrenched to them but one needs to be able to discriminate between ICOs and bitcoin.

ICO Explained: An ICO is an initial coin offering and all it does is to try and bypass traditional funding systems. When a startup or a small business needs to raise money, they can do so by either using their own funds or asking a bank to lend them or trying to convince an angel investor or a VC to buy equity. An ICO is, in essence, an early stage IPO. The company introduces its concept in a white paper and issues coins that are worth an equity stake in the company and every person interested in investing can acquire these coins. This is an interesting system but it also begs the question of how many of the ICOs out there are legitimate. Many people are buying into the ICO craze and invest in companies without even understanding major investment principles. Evidently, this creates a bubble; a bubble that surely will burst at some point.

The game is a marathon and not a sprint. It is a game that involves high stakes, risk, drama, influence, persuasion, money, politics, psychology, philosophy, economics, and history.

For some reason, it is a game many people find tantalizing.

And, sometimes, that’s all it takes to play a game and, eventually, redefine our world forever.

What should I do as a bitcoin beginner: Many people have asked me if it is too late to buy bitcoin. Well, my personal view is that it is still a great time to buy bitcoin. Of course, it would be great to have bought 2–5 years ago, but I believe that we haven’t reached the peak of its price. That is because it is still a young technology, it is not mainstream yet, and we haven’t experienced its full potential. I don’t really think that bitcoin will ever go beyond $100,000 because that is insane, but it could rise up to $60,000-$100,000 at some point. I see bitcoin the same way I see stocks. Its value is predicated upon how effective it is as a “business” and how much people value it. For instance, if you bought $10,000 worth of Amazon stock back in 2000 when the price was $20, today you would probably own half a million dollars. As a general rule of thumb, I advise people to not invest more than they are willing to lose. Also look at other cryptocurrencies and follow the same tactic. All you need to do is educate yourself. Knowledge is power. Also, in case you decide to invest, make sure to diversify with regards to where you keep your crypto. I suggest using a popular platform like Coinbase and a hardware wallet like the Ledger Nano S or Trezor.

This article is written Bitcoin evangelist himself Andrian Iliopoulos and was fist published on Hackermoon.com.